With respect to paying down credit debt, compounding interest levels makes repayment feel just like an uphill competition. While an excellent Canadian homeowner hoping to get out of using your credit card debt, you happen to be eligible to explore a home collateral loan so you’re able to pay your balance.

Is actually property guarantee mortgage a good choice for your requirements? Contained in this guide, we protection the basics of paying down loans which have a house security financing in addition to related professionals and you may risks.

Repaying Credit debt having a home Security Financing: Masters and you will Dangers

Before making a decision to take out property guarantee financing, it is very important to take on advantages and risks you can also bear.

The many benefits of a property Collateral Financing

Property security financing is rather benefit residents unable to repay its charge card debts. Listed below are some of one’s biggest experts:

- Lower Rate of interest: after you pay off their credit debt with a home collateral loan, your effortlessly decrease your rate of interest. An average house equity rate of interest is just one-next of your average bank card interest rate. Reducing your attract will set you back can save you plenty in the much time work with.

- Debt consolidation reduction: for those who have numerous handmade cards that need to be paid down, property collateral financing enables you to pay them all of the from immediately. Next installment, you’ll combine the monthly financial obligation money off several private cards costs for the one house security financing payment. Merging the debt will even subsequent decrease your desire.

The dangers away from a house Equity Mortgage

If you find yourself a house security financing will be perfect for your, it is extremely vital that you check out the dangers before making good decision. Listed below are some prospective drawbacks:

- Your residence due to the fact Equity: the largest drawback of a home equity mortgage is the fact the home is made use of as the collateral-if you fail to pay the main number within the specified months, you risk losing your house. not, for those who approach the loan rationally and funds your payments in the future of energy, the chances of that it taking place was lower.

- It’s also possible to Gather More Obligations: when you are property equity financing can be a terrific way to pay-off your bank card debts, it is critical to consider your current financial situation. If you are not confident in what you can do to repay their domestic security mortgage, you will probably find oneself much more debt than in the past.

Options to Repaying Their Credit card debt

When the a home security loan will not sound like the proper complement you, there are some additional options you can consider. Here are a few choice an effective way to pay off their credit cards debt:

Switch to a lowered-Notice Credit card

The largest hurdle when repaying personal credit card debt ‘s the growing cost of combined appeal. Desire to your charge card payments, particularly late costs, substance and can quickly spiral out of hand.

Luckily for us, of many creditors provide offers for new website subscribers that may reduce your interest expenses. You are able to transfer all of your debts onto good brand new bank card you to definitely fees 0% attract into the first year . 5. When you find yourself going your debt to another credit does not generate it fall off, it does make you more time to catch up on the payments without paying large attract fees.

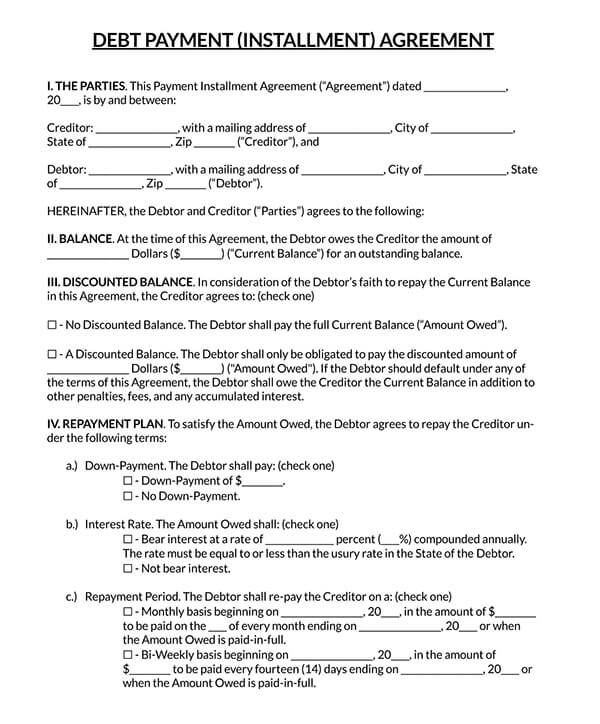

Perform an installment Package

The earlier you pay back the personal credit card debt, the greater amount of money it will save you. Whatsoever, you can’t getting billed notice to your financing which was completely paid back. For people who just make the minimum expected monthly payments, it entails for years and years to pay off your debt totally. We recommend that your finances your income to blow away from as frequently of mastercard statement as you’re able to, as fast as you might.

Borrow cash From the RRSP

When you have extreme capital in your Joined Advancing years Offers Package (RRSP), you are lured to withdraw that cash to assist shell out out-of your own charge card expenses. https://paydayloancolorado.net/sheridan Although this will likely be a good idea if you do not have to put your home right up as security, withdrawing out of your RRSP does have several setbacks.

While withdrawing from the RRSP, and it is not to purchase your very first house or fund their studies, you happen to be at the mercy of a beneficial withholding tax upon withdrawal as better since the an extra income tax. Even with such limitations, repaying the debt is oftentimes really worth the extra cost.

Query the pros

When you find yourself struggling with the option ranging from a house guarantee financing otherwise a choice route, Clover Financial may help. We are dedicated to debt consolidation reduction money and also access so you can an enormous network more than 50 various other lenders. All of us can help you discuss the options to check out in the event that a home equity loan suits you.