- Spend money on equipment

- Make or revision current business

- Get present belongings otherwise houses

- Write homes parking, surface, roadways

https://cashadvanceamerica.net/payday-loans-fl/

- Refinance loans associated with business expansion, and additionally the or dated possessions and gizmos

Hard Currency Financing

Individuals that are struggling to secure commercial financing often have a good reputation for property foreclosure otherwise a preliminary profit on the financing.

Hard money fund is actually supplied from the private lenders for as long as you really have adequate collateral finalized due to the fact a guarantee to the loan. This type of money will come in quick terms and conditions, such as for instance 12 months as much as 24 months. If you’re looking for brief-title money to maneuver your business or reconstruct your institution, you could utilize this brand of loan.

But not, need caution. Private traders can be vital regarding repayment. They may together with create criminal background checks on your borrowing. They foot financing acceptance on worth of in the place of heavy mention of creditworthiness. Furthermore, hard currency money usually consult a high rate of interest off ten percent or more compared to traditional industrial mortgages.

In case your lender sees you’re not promoting the fresh new consented income, they could cut your money. Certain individual lenders might even grab property finalized since the security till they discover proof of go back away from financial support. Remain these types of dangers at heart before signing up getting a hard currency financing. For many who very must take they, definitely have enough financing to pay for your angles.

Link Financing

Link fund act like difficult money financing whether or not they are able to history to three years while the interest tends to become somewhat down – on six% in order to 10% range. One another bridge and hard currency finance are generally appeal-merely funds.

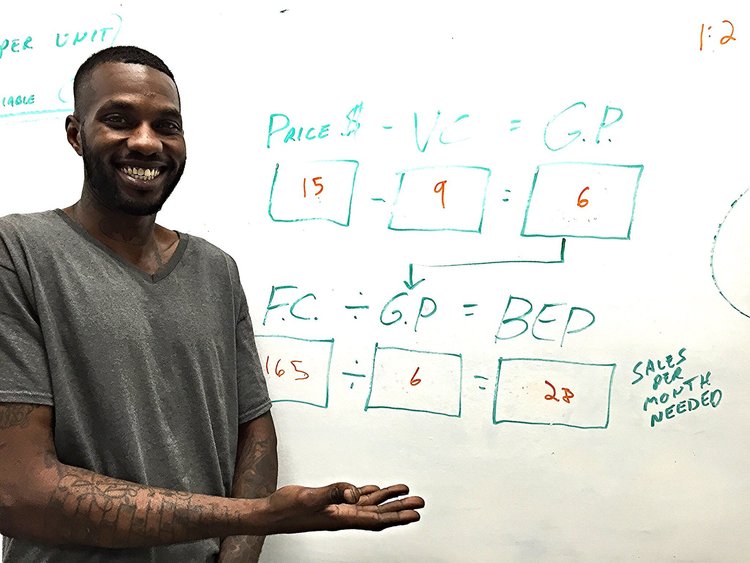

Commercial loan acceptance relies on your own creditworthiness since a business owner. When a lender features a loan, they believe your providers often build sufficient payouts to spend back the loan. That being said, a professional bank can only just approve the loan just after carefully examining debt standing.

Loan providers make reference to around three main brand of criteria prior to giving good commercial financial. These types of official certification were your company cash, personal money, and the property’s qualities. However they look at the personal and you can organization borrowing from the bank scoremercial loan providers comment their bookkeeping instructions to verify for those who have enough cash flow to repay the borrowed funds.

Except that your finances, industrial underwriters and additionally have a look at your business character and your company lovers. They are going to actually evaluate your online business package and check their projected money predicated on your goals. As a result of this tight underwriting procedure, new enterprises keeps a tough time delivering its mortgage recognized.

Organization Credit rating

Lenders evaluate your business credit score to guage the appropriate attract rate, fee label, and you can advance payment required for your loan. A higher credit history will provide you with deeper likelihood of protecting a great industrial financing approval.

Who Ratings Organization Borrowing from the bank Users?

There are three no. 1 credit bureaus that assess team credit scores. Listed below are three main kind of business credit ratings classifications used by lenders:

- FICO LiquidCredit Business Scoring Provider (FICO SBSS rating) Which borrowing from the bank system ranges away from 0 to 300, having 3 hundred as being the higher. The minimum expected FICO SBSS rating are 140 to have a little Business Administration mortgage pre-monitor. However, basically, 160 is far more preferred by lenders.

- Dun & BradstreetPAYDEX Rating The corporation borrowing program features a level anywhere between step 1 to 100, that have 100 as the very best rating. Results anywhere between 80 and you can 100 are considered reduced exposure, boosting your organizations trustworthiness in order to lenders. Thus go for a top credit score of 80.